This is the first of our ‘Understanding SMSFs‘ series – a sequence of articles where we break down the nitty gritty of what an SMSF actually is, how to set one up and potential tax benefits.

The What and the Why

What is an SMSF?

A self-managed super fund, or SMSF, is essentially a ‘DIY super fund’ – a private superannuation fund that you manage yourself. SMSFs can have up to four members. If you’re a member of an SMSF, you’re also a trustee. This means you’re responsible for complying with super and tax laws, as well as running it for your own benefit.

SMSFs are a way to save for retirement. In recent years, the number of SMSFs in Australia has increased from 521,511 to 586,225 in 4 years.

At first glance, setting up an SMSF may seem daunting. It does come with potentially costly and burdensome legal and administrative responsibilities. Despite this, it is important to have a clear understanding of the benefits and risks that come with setting up and managing an SMSF. This way, you can make an informed decision about how you meet your financial goals. You may find that an SMSF is the right choice for you!

Why do people choose SMSFs?

One of the main reasons for setting up an SMSF, is autonomy. An SMSF allows you to be responsible for all investment decisions. This means you can choose investments which align with your risk tolerance and your financial goals.

On top of this, you have the flexibility of adjusting your investments to suit changes in market conditions, laws, regulations and your personal circumstances.

However, autonomy doesn’t mean you’re left to fend for yourself. It is very common for SMSF managers to seek external advice from financial planners, accountants, legal practitioners and other professionals. The Commonwealth Bank’s 2018 research shows that around 13% of SMSF members outsource their investment decisions to a financial planner.

Only 30% make investment decisions entirely on their own, and even then, it is common for them to consult an accountant. It is actually recommended that individuals seeking to set up an SMSF, seek professional advice to ensure laws and regulations are complied with.

Managing your own super fund gives you transparency as you know exactly where your money is going.

Like all super funds, SMSFs benefit from concessional tax rates (i.e. lower tax rates). In the accumulation phase, tax on investment income is capped at 15%. In the pension phase, investment income is not taxed at all.

Who can set up an SMSF?

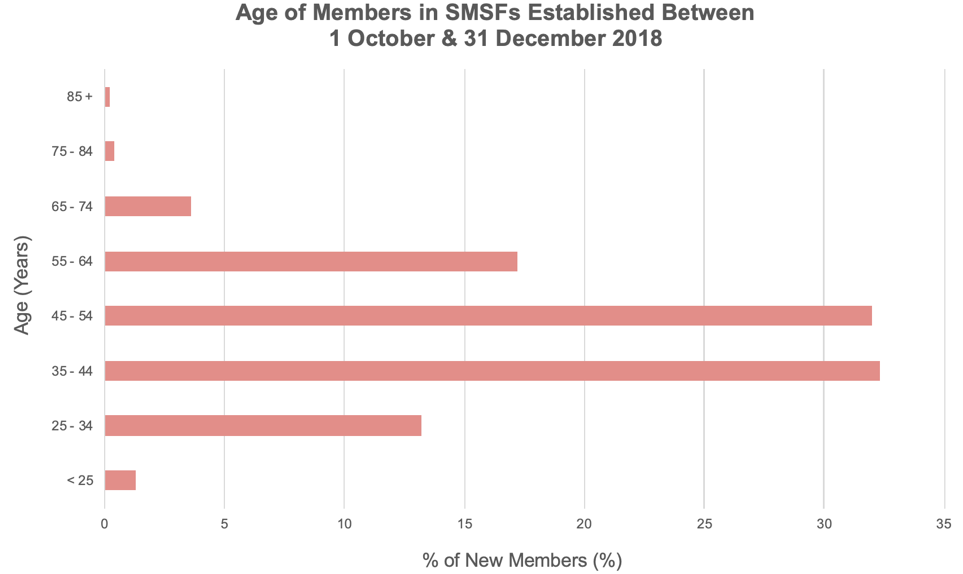

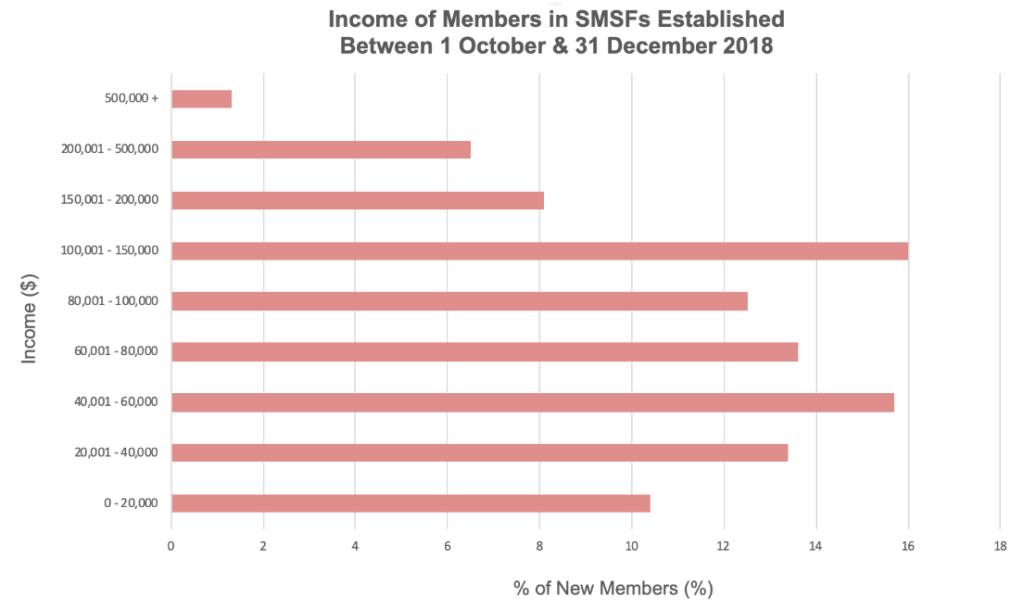

Most SMSFs are set up by members between the ages of 35 and 44, who are earning between $100,000 to $150,000 per year. That being said, individuals of all ages and income levels set up SMSFs. You can see this in the graphs below, which are based on data from the Australia Taxation Office.

Conclusion

No matter your current age or income level, SMSFs are something to keep in mind and consider. In our next article, will discuss the steps involved in setting up a SMSF and how to invest in property through your SMSF.

Did you know? There are currently over 150 members who invest their SMSF with BrickX!

Next up in the Understanding SMSFs series:

Feature image thanks to Tierra Mallorca | www.tierra-mallorca.com