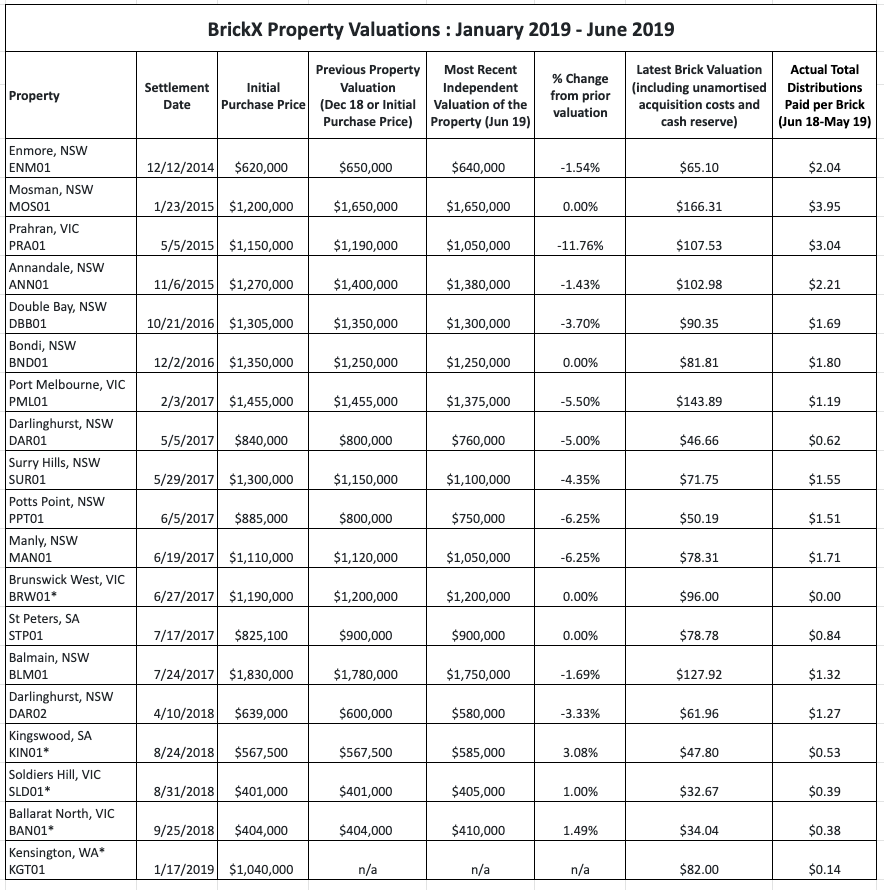

BrickX properties are independently revalued every six months. The valuations for January 1, 2019 – June 30, 2019, are in. See our previous valuations here.

Quick Snapshot

It’s been an interesting time for the Australian property market. After what is said to have been the longest and deepest property downturn in modern history1; the prospect of easier access to finance, a tax cut and falling interest rates are now contributing to a more positive outlook.

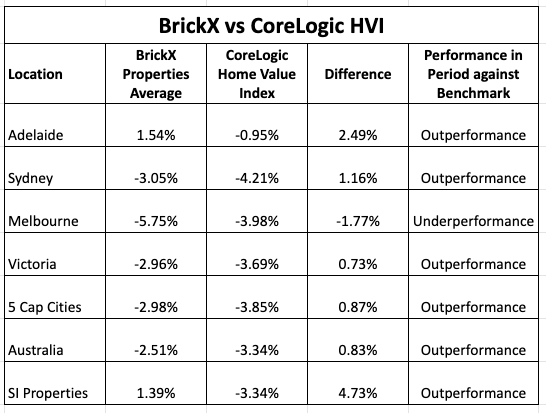

According to the CoreLogic Home Value Index, Australia’s 5 capital cities appear to be recovering – with the decline slowing from -4.80% in Dec 2018 to -3.85% in June 2019. Overall, we are pleased that the BrickX properties have held strong – with our portfolio outperforming the Cap City average by 0.87% and Smart Invest portfolio outperforming the Australian average by 4.73%!

n.b. Cap City figures do not include our regional properties – Soldiers Hill (SLD01) and Ballarat North (BAN01) which have been analysed below against the Victorian average. Additionally our newest property, Kensington, Perth (KGT01) has not been revalued as it has been on the BrickX Platform for less than 6 months. This property will be revalued for the first time in December 2019.

Adelaide

Although there are economic and employment factors which influence a cities livability, Adelaide is currently the most affordable Capital City in Australia according to Michael Yardney (Director of Metropole Property Investment Strategists)2. The market has decreased by 0.95% over the last 6 months since Dec 2018, and our BrickX properties have performed better than the market – St Peters (STP01) remained flat at $900K and Kingswood (KIN01) has outperformed with a healthy increase of 3.08%!

Sydney

Improved sentiment post-election appears to be boosting prices in Sydney. Despite a decline of -4.2% over the last 6 months, the market is improving on the -6.3% decline from Jun-Dec 2018. The great news is that the 11 properties BrickX own have outperformed the market with the average price dropping by -3.05% vs -4.21%. Individually the properties had varying results – Mosman (MOS01) and Bondi (BND01) remained flat with Manly (MAN01) and Potts Point (PPT01) suffering the largest decline each at -6.25%.

Melbourne

The Melbourne market is very fragmented so while the BrickX property average is underperforming compared to the index, this average is hugely swayed by the outlier Prahran (PRA01) which unfortunately declined by 11.76% in value. Port Melbourne (PML01) dropped by 5.50%, which is inline with the wider market however Brunswick West (BRW01) has fared well, remaining flat at $1.2M.

Regional Victoria

Our two regional Victorian properties – Soldiers Hill (SLD01) and Ballarat North (BAN01) have returned fantastic valuations with the properties each outperforming their previous valuations by 1.00% and 1.49% respectively. The Victorian market as a whole has underperformed by -3.69%.

Smart Invest

Overall our Smart Invest portfolio has outperformed the Australian average by 4.73% delivering a solid performance for our members given current market conditions .

- BRW01 – Has Required significant capital work and will continue to pay no distribution till end of 2021

- KIN01 – Partial Year of Distributions due to Acquisition in Aug 2018

- SLD01 – Partial Year of Distributions due to Acquisition in Aug 2018

- BAN01 – Partial Year of Distributions due to Acquisition in Sept 2018

- KGT01 – Partial Year of Distributions due to Acquisition in Jan 2019

Our Property Team’s view of the market

The BrickX Property Team meet quarterly to discuss the state of the Australian property market and BrickX’s investment strategy. Our last meeting (May 2019) was post-election and reflects the positive shift in sentiment across the market.

For details on how the latest property valuations impact your account, please go to the Advanced View of your Dashboard.

For insight into the ups and downs of the property market, see Timing the market with the Property Clock.