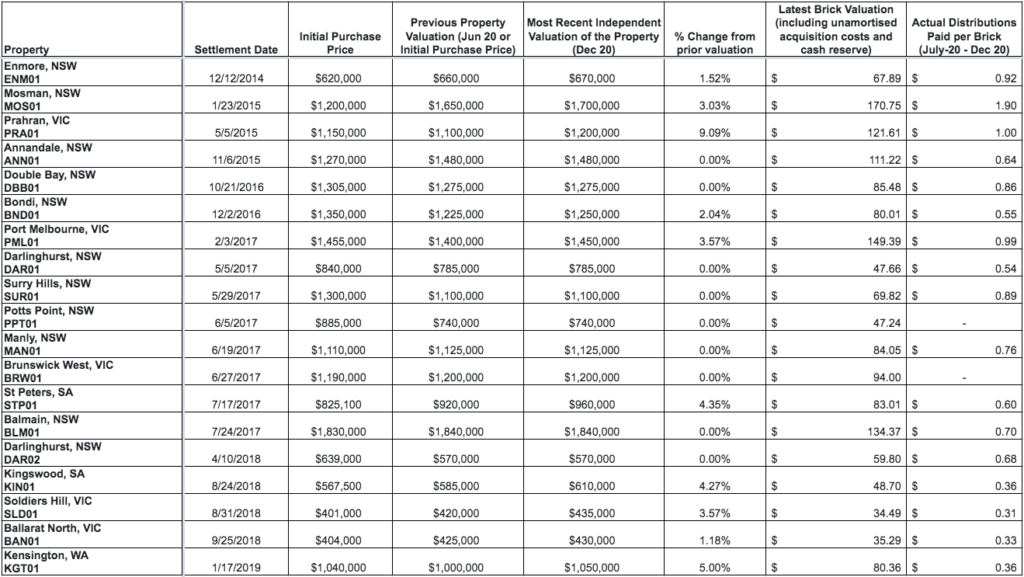

BrickX properties (Trusts 1-19) are independently revalued every six months. The valuations for July 1, 2020 – December 31, 2020, are in. See our previous valuations here.

Quick Snapshot

Despite the ongoing effects of COVID-19 throughout the second half of 2020, the Australian property market demonstrated remarkable resilience to rebound from a 2.1% drop and finish the year strongly.

According to the Corelogic Home Value Index Report[1], record low interest rates and Government support measures played a key role in supporting housing market activity, along with a spectacular rise in consumer confidence as COVID-related restrictions were lifted and forecasts for economic conditions turned out to be overly pessimistic.

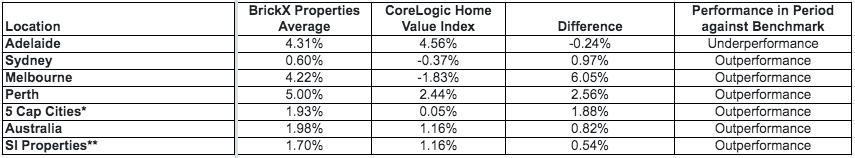

Australia demonstrated growth of 1.16% in the second half of 2020 and finished the year up 3% overall. The BrickX portfolio saw stronger growth with its portfolio valuation increasing by 1.98% over the previous corresponding period. 10 of its 19 properties (53%) saw increased valuations, with the remaining 9 properties maintaining their value from June 2020.

Summary Portfolio Performance (December 2020)

* BrickX regional properties in Ballarat are excluded.

** SI Properties only includes those in the SI mandate and excludes Trusts 22-26, these properties will be included at the next revaluation.

The Valuation Method – BrickX engages an independent, external valuer for our valuations every six or twelve months. Our valuers use a direct comparison method utilising comparable evidence for all properties in our portfolio. This means that valuations are based on historical sales of properties with similar characteristics in the same suburb over the period.

Valuations by Property (December 2020)

[1] Source: Corelogic https://www.corelogic.com.au/sites/default/files/202101/CoreLogic%20home%20value%20index%20Jan%202021%20FINAL.pdf