People often talk of property investing as though there’s a one size fits all strategy, depending on the current market trends. However, the ideal property investment strategy for you will depend on your personal needs, and how to best optimise your current assets.

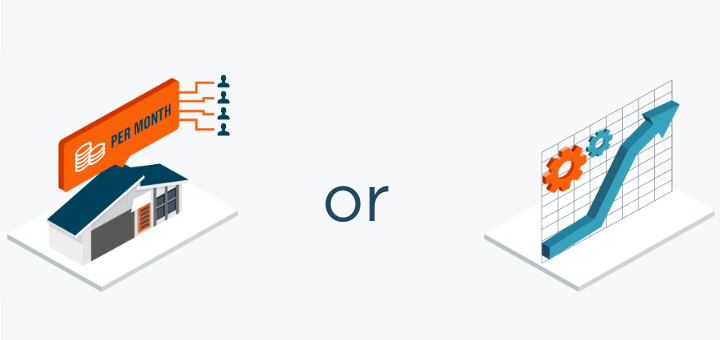

One distinction is whether you should be looking for good rental income from your investment or trading off a lower income earner now for a higher level of anticipated capital growth. In many areas, rising property prices over recent years have not been matched by the same level of rental growth. In some of Sydney’s most sought-after suburbs, for example, rental yields have fallen below 3 per cent. And a similar situation exists in other major capital cities. But if you’re looking for capital growth, the highly sought-after, inner-city suburbs often deliver higher rewards.

So what do you go for?

The growth strategy

If you opt for capital growth, you’re trading off money in the hand today for the promise of higher returns in the future. Technically, this is the riskier strategy but it can also deliver greater rewards.

If you have a secure personal income, targeting capital growth can also have tax advantages. As your rental income is unlikely to cover interest and other expenses, you should be able to negatively gear your investment by offsetting the annual losses against other income. Under the current tax rules, capital gains also receive concessional tax treatment. Only half of any gain you eventually make is included in your income for tax purposes if you hold the property for 12 months or more. So if you’re in the top marginal tax rate of 47 per cent, including the Medicare levy, you will pay only 23.5 per cent tax on your investment profit.

With some planning, you may also be able to reduce that capital gains tax further by selling the property in a year in which you are earning less income, but you need to ensure you can afford the loan repayments until then, as you don’t want to be forced to sell into a weak market.

And for the strategy to work, the property’s longer-term capital growth must be higher than your costs.

Stamp duty is one of the biggest costs involved when purchasing a property. It is an additional cost to be factored in when considering selling and calculating your returns. As such, this is one of the reasons why property investors hold on to their investments, waiting for the ideal time to sell, so that the profit will recoup the stamp duty paid.

The income strategy

With low interest rates, on the other hand, a property with a yield of 4 to 6 per cent can pretty much finance itself. You shouldn’t have to put your hand in your pocket each month to find money to cover expenses such as interest, council rates and management fees.

This is known as positive gearing. It means you are making a profit from your investment from day one rather than relying entirely on future growth. Of course, you’ll have to pay tax on any annual profit, but it can be a handy way for people who don’t have high incomes to afford property investment. Some investors see higher-yielding property as a strategy to build passive income streams that eventually they will be able to live on – especially in retirement.

Of course, it isn’t just one or the other. Many property investments offer a mix of income and growth potential. It really comes down to your personal investment risk profile and objectives as to which you choose. BrickX makes it easy to enter and exit the property market, and is a cost effective way to do so too.

The BrickX business model provides for income and capital growth investing, and by structuring investment parcel sizes, investors do not pay any stamp duty on reinvestment. Investing in individual residential properties online like this allows you to find a property investment mix that matches your objectives, without the full burden of costs associated with purchasing property.

The opinions and beliefs expressed by the authors and forum participants as part of this communication do not necessarily reflect the opinions and beliefs of BrickX, BrickX Financial Services or other entities within the BrickX group.