Fractionalised investing, as the name suggests, involves investing in a fraction of an individual asset. The most common type in Australia is fractional property investing where the cost of a property is divided into units, and sold to investors who each then “own” a portion of the property.

According to Demographia’s 15th Annual International Housing Affordability Survey1 , both Sydney and Melbourne were listed in the top 10 most expensive cities in the world (all five Cap Cities ranked in the top 20). So with traditional home ownership feeling unattainable for many Australians, whether they are first time buyers or seasoned investors, options such as fractional investing provide an alternative, affordable, solution for those who want their slice of the great Australian dream.

Why choose fractionalised investing?

The most obvious benefit to fractional investing is the low barrier to entry, thanks to dividing the cost of a property into units, a stake becomes much easier to acquire.

The second benefit is diversification. Due to the initial expense of purchasing a property, it may not be possible for investors to own more than one. Therefore, rather than placing an entire pool of funds in a single property, investors can gain access to a wide range of properties in a portfolio. More sophisticated investors may seek to minimise risk through the diversification of property investments, as well as diversification across asset classes.

Another positive aspect of fractional investing is the access to liquidity on any secondary market. Selling a property can often take a long time due to things like settlement periods, whereas fractional property can often be sold in a shorter period of time – given there is a willing buyer, of course!

Although they are not considered financial benefits, another two advantages are being able to invest in a property that is located interstate – allowing you to hold a stake in properties you may not have had access to previously. And not being responsible for the day-to-day management of a property, meaning no pesky tenants or strata meetings!

How do you earn returns?

Investors are entitled to a share of the properties returns – this includes rental income and any capital returns if the property is sold. On any secondary market the price of the trust generally tracks the value of the value the property.

Are there downsides?

A possible downside to fractional investing is that returns are proportionate to the amount you invest. Consequently, short-term rental income from a fractionalised property investment may not be as substantial as rental income earned from investing in an entire property. Rental income from a fractionalised property investment may be further eroded by expenses, maintenance, transaction and other fees.

Traditionally, property has been considered to be a slow-burn investment strategy. Whilst it is less volatile than some other investments, any potential returns will be accumulative over the long-term.

Fractional investing with BrickX

BrickX launched in 2015 and are backed by Westpac Reinventure and NAB Ventures. We are a fractional property investment platform, specialising in residential properties, with a focus on blue-chip suburbs and good rental yields.

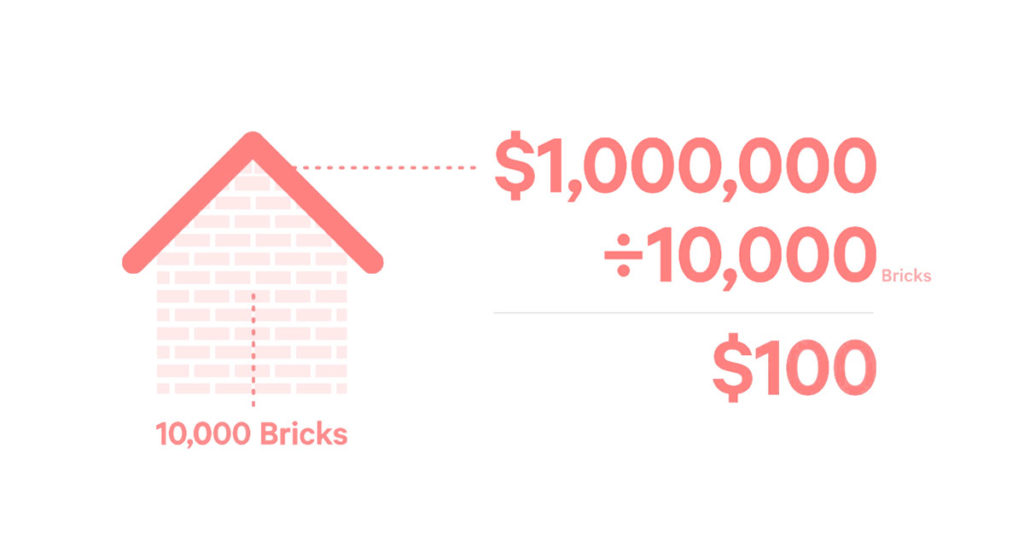

BrickX purchases properties, and keeps each property in a trust. Each property trust is divided into 10,000 Bricks which investors can buy. Investors and buy and sell Bricks on the BrickX platform and receive monthly rent payments in proportion to the size of their investment. There are 19 properties currently available on the platform.

Let’s say a property trust is worth $1,000,000. Bricks are valued by splitting the value of the property trust into 10,000 Bricks. For a property trust worth $1,000,000, every Brick has a value of $100.

The liquidity, or ease of buying and selling Bricks [as opposed to an entire property], allows investors to adjust the size of their investments, how many Bricks they hold in a property and how much of their investment portfolio they allocate to Bricks. Investors may be motivated to do this by the performance of each property, the economy, and their personal risk preferences.

One thing to note; fractional property investing doesn’t allow an investor to take advantage of tax benefits such as negative gearing. A company like BrickX allows investors to purchase Bricks in geared properties for example, the property at 29 Campbell Street in Western Australia has a gearing ratio of 28%. While buying Bricks in geared properties allows for higher returns, Brickowners do not have access to the direct tax deductions associated with negative gearing. These benefits are only available to investors if they have purchased an entire property and monthly interest payments and expenses exceed the rental income received. Find out more in this article about Negative Gearing, and how Labor’s policies affect you.