BrickX properties are independently revalued every six months. The valuations for January 1, 2020 – June 30, 2020, are in. See our previous valuations here.

Quick Snapshot

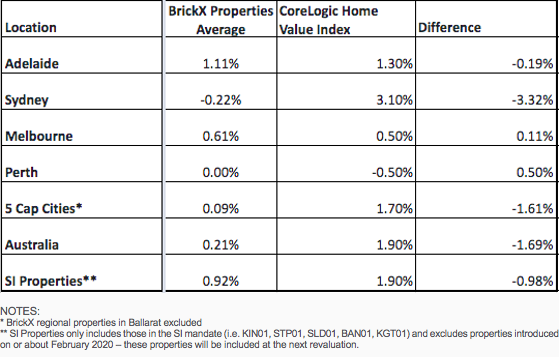

It’s been an unprecedented time for the Australian property market during Covid-19 and the associated lockdown with reduced supply supporting values, noting the Government and Finance sector also supporting the broader economy during this period. BrickX’s tenancy profile has not been significantly impacted during this time, with the exception of the current vacancy at PPT01. According to the CoreLogic Home Value Index, Australia has demonstrated remarkable growth of 1.90% for the year to date June 2020. Overall, the BrickX portfolio has seen relatively lower growth, with our portfolio valuation increasing by 0.21% over the period. This was supported by increased valuations across our portfolio from 8 of our 19 properties (42%) in the last six months.

Looking forward, the shape of the economic recovery remains uncertain. As a guide, CoreLogic are of the view that we are likely to see a diverse outcome for housing markets around Australia, depending on how well the virus is contained and the region’s exposure to other factors such as its reliance on overseas migration as a source of housing demand[1].

Summary Portfolio Performance (June 2020)

The Valuation Method – BrickX engages an independent, external valuer for our valuations every six months. Our valuers use a direct comparison method utilising comparable evidence for all properties in our portfolio. This means that valuations are based on historical sales of properties with similar characteristics in the same suburb over the period. We appreciated your patience in allowing us to progress these independent valuations during this difficult Covid-19 period, which also included full valuations for a sample of properties.

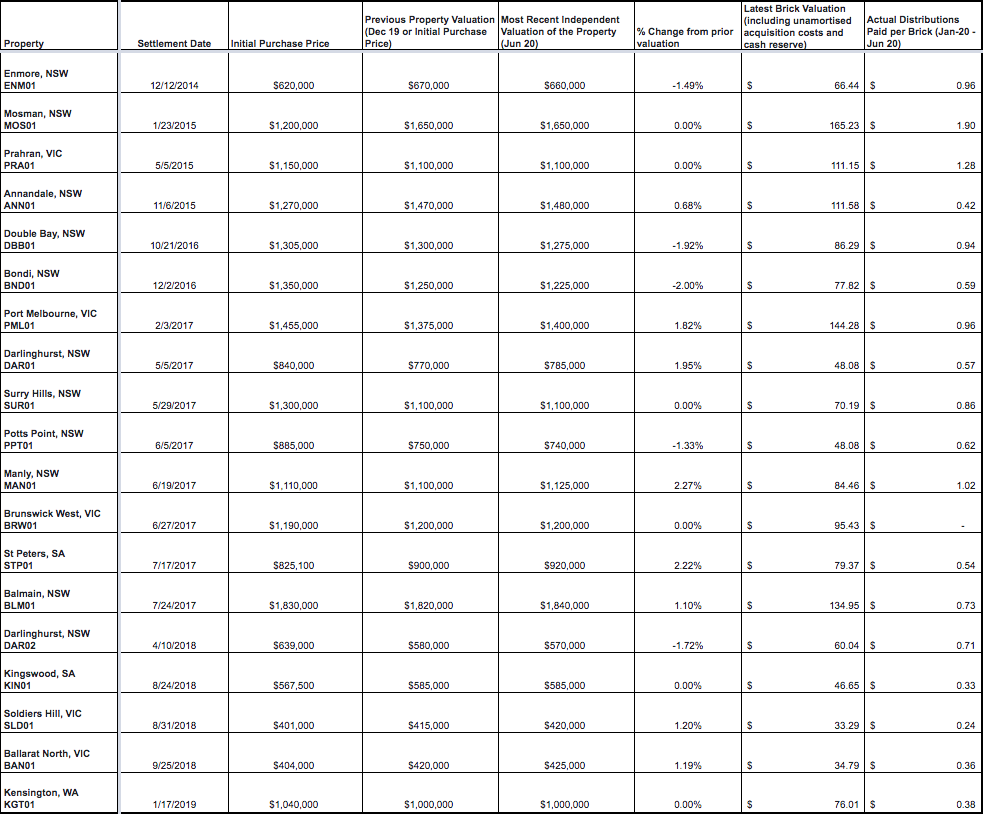

Valuations by Property (June 2020)

[1] Source: https://www.corelogic.com.au/news/australian-housing-values-record-fourth-month-decline-down-04-august-trends-beginning-diverge