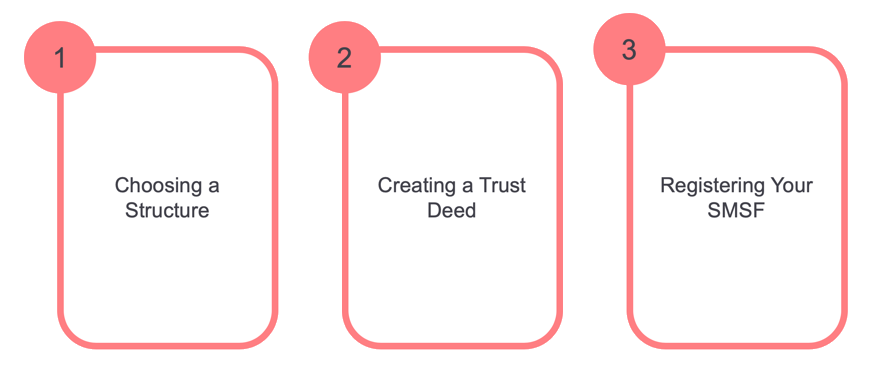

This is the third edition of our ‘Understanding SMSFs’ series, where we break down the nitty-gritty of SMSFs. In this post, we’ve broken down the setup process into 3 simple steps.

In case you missed our earlier posts in the series, find them below:

How to set up an SMSF?

How do you go about setting up your DIY super fund? We’ve broken down the process into three main steps.

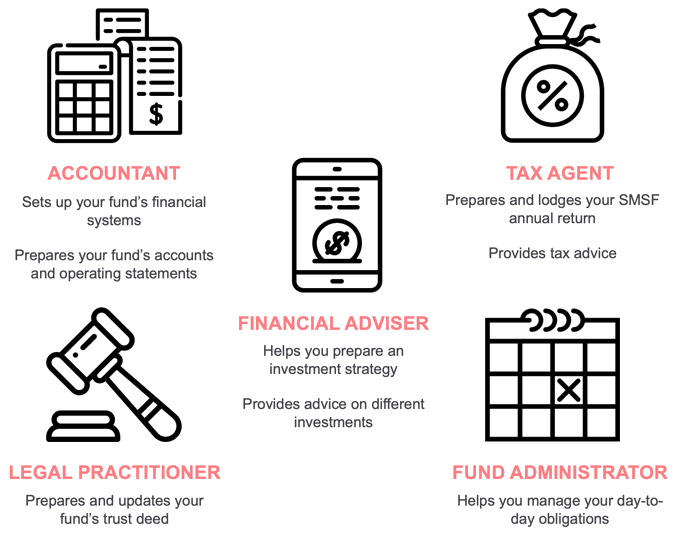

Before you begin, it’s important to consider hiring professionals to help you with the process. As we mentioned in our first Understanding SMSFs post, most individuals who have set up an SMSF, appoint a financial adviser, accountant and/or a legal professional to help them with investment decisions and ensure they are legally compliant.

Some people you may need to work with include:

The following guide is based on information provided by the Australian Taxation Office (ATO). For more details on the process of setting up an SMSF, you can visit the ATO website.

Step 1: Choosing a Structure

An SMSF has up to four members. There are two ways of structuring your SMSF:

Individual trustees:

With individual trustees, you must have two to four members, who are also trustees.

Corporate trustee:

Having a corporate trustee means a company is acting as the trustee for your fund. With a corporate trustee, you can have one to four members. Each member of the fund is a director of the corporate trustee company.

A corporate trustee must be registered with ASIC. ASIC charges an upfront fee, and an annual review fee.

No Employee Rule:

Note that a member of an SMSF cannot be employed by one of the other members of that same SMSF. The exception is if they are relatives.

Step 2: Creating a Trust Deed

SMSFs and super funds in general are a type of trust. A trust is a legal structure where a person or company (the trustee) holds assets (trust property) in trust for the benefit of others (the beneficiaries).

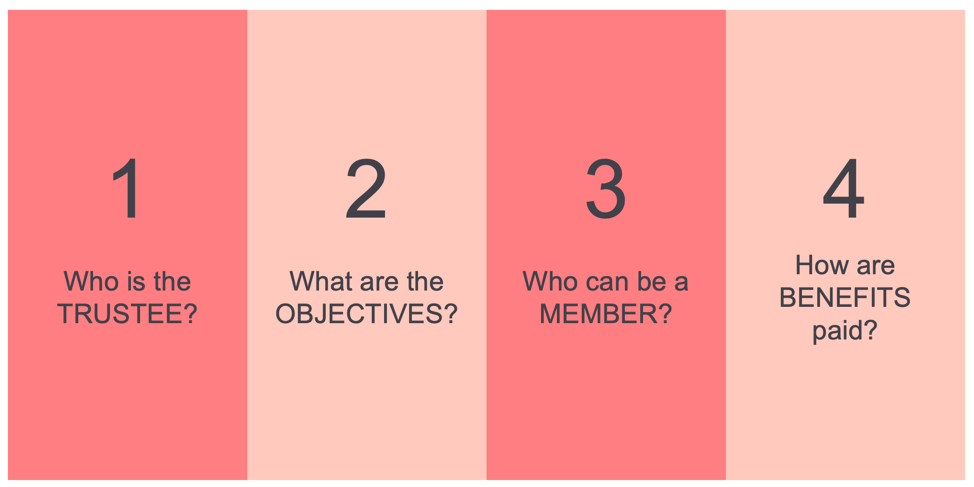

A trust deed is a legal document used to set up a trust. The trust deed for an SMSF would set out details including:

The trust deed should be prepared by someone who is qualified to set it up as a legal document, and signed and dated by all trustees.

Step 3: Registering Your SMSF

Once your fund is established and you have appointed the trustee(s), you have 60 days to register the SMSF with the ATO by applying for an Australian Business Number (ABN).

If you have hired a tax professional, they can use the Australian Business Register’s ‘Tax Professionals Services’ to register your SMSF and apply for an ABN on your behalf.

On the application form, you will be asked to elect for the fund to be regulated by the ATO. Remember to formally elect for the fund to be ATO-regulated. This way, you can receive tax concessions.

The ABN application form will require the following details:

- Name of the SMSF

- Date the SMSF came into existence (this is the date on which you created the trust)

- SMSF business details (at least one business address)

- Electronic fund transfer details

- Authorised contact details

- Personal details relating to the SMSF’s associates (individual trustees, corporate trustees, members, directors of a corporate trustee)

Is your fund an Australian super fund?

Before registering your fund, you need to ensure your SMSF is an Australian super fund at all times during the financial year. This allows you to be eligible for tax concessions.

Three residency conditions need to be met for your SMSF to be an Australian super fund:

- The fund was established in Australia. This means the initial contribution to establish the fund was paid and accepted in Australia.

- Central management and control of the fund is in Australia. This means the SMSF’s strategic decisions such as formulating an investment strategy and reviewing its performance, are made in Australia.

- The fund’s active members are Australian residents and hold at least 50% of the total market value of the fund’s assets attributable to super interests (or benefit entitlements). An active member is a contributor to the fund or someone who has had contributions made to the fund on their behalf.

With enough patience, research and the right professional help, who knows? You could soon be investing with your own certified SMSF!

Did you know? There are currently over 150 members who invest their SMSF with BrickX!

We’ll be publishing the next article in our Understanding SMSFs Series on the BrickX News page soon. Watch this space!